ABOUT CREDIT CARDS

It can also be a smart card that contains a unique card number and some security information such as an expiration date or with a magnetic strip on the back enabling various machines to read and access information, Depending on the issuing bank and the preferences of the client, this may allow the card to be used as an ATM Card, enabling transactions at automatic teller machines; or as a debit card, linked to the client's bank account and able to be used for making purchases at the point of sale; or as a credit card attached to a revolving credit line supplied by the bank.

What is Credit card:

A credit card is a card issued to consumers that is used to make purchases, with the agreement that the cardholder will ultimately pay back the card issuer for the cost of the items purchased, along with any agreed upon fees and interest, should they be assessed. Essentially, a credit card acts as a loan that allows you to make purchases now and pay them back (often with interest) later.

A credit card, used wisely, is one of the most effective financial payment tools available to consumers of all ages. You usually have a grace period between 21 and 30 days after the close of the billing cycle to pay back any money without interest.

After that, you may accrue interest depending on your card (unless your card offers a 0% interest promotional rate for a period of time). Credit cardholders will be charged interest on the amount borrowed and will be expected to make (at least) minimum monthly payments until the balance is paid off.

Credit cards come with a maximum amount of money (known as a credit limit) which can be used over a specific period of time. That credit limit is determined in large part by the credit cardholder's credit scores and reports, which the credit card company will review before granting approval to the credit card applicant.

When using the card to buy goods or services, the cardholder is authorizing the credit card company to make the purchase for them, with the promise to pay the exact amount back at a later date.

Credit card companies will log the purchase and add it to the credit cardholder's statement and issue a bill at the end of the billing period tallying all the credit cardholder's purchases, the amount of each purchase, and the total amount owed on those purchases.

The card issuers will add an interest charge to any account balance that isn't paid on or before the invoice due date. Added interest is a detriment to cardholders, as that interest compounds over time, as long as there is an unpaid balance.

Features of credit card

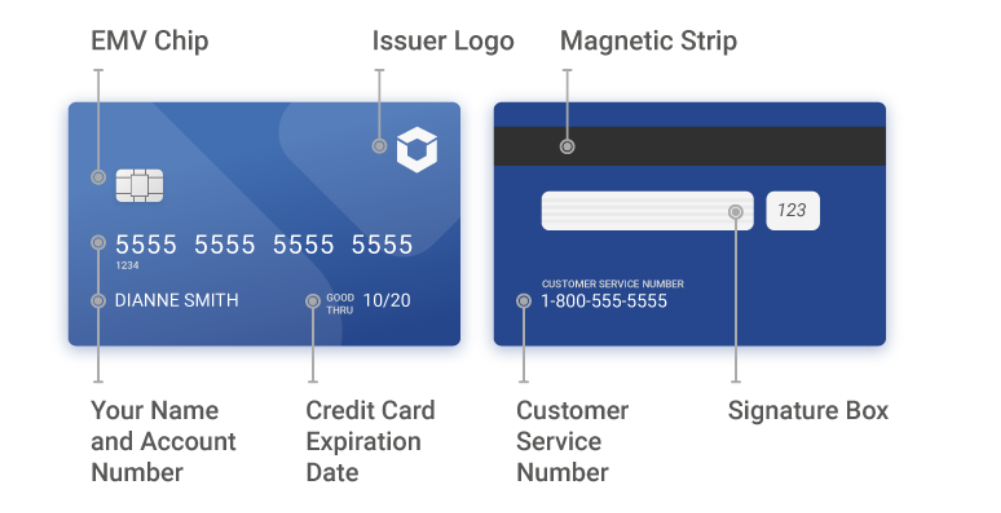

Credit cards have various components, and each one should be understood by cardholders:

- Issuer Logo: The issuing bank logo is on the front of the credit card. While the issuing bank (think Bank of America or Wells Fargo, for example) provides cardholder, the credit card payment network (think Visa and MasterCard) process card payments.

- Europay, MasterCard, and Visa (EMV) Chip: The EMV chip, which has become pervasive around the world in the last decade, stores card data on a computer chip in an encrypted fashion, thus making it harder for fraudsters to steal the card number.

- Magnetic Strip: Credit cards also have magnetic strips, which are readable through some specific machines used for monetary transactions, and also contain account data.

- Your Name and Account Number: Your name as it appears on your credit card application appears on the front or back of the card, as well as your account number.

- Credit Card Expiration Date: Your card expiration date shows merchants the month and year when your credit card.

- Customer Service Number: The card issuer provides a customer service number on the back of the credit card, to resolve problems and provide information on credit card usage and options.

- Signature Box: Credit cards include a field where cardholders are supposed to sign their name.

Credit cards offer myriad positive benefits to credit card holders:

1. Using Credit Cards Can Make It Easier to Track Your Spending

By using the credit card issuer's website, you can easily check your online account to get a clear picture of your recent card activity. Additionally, credit cards usually come with significantly more fraud protection than a traditional checking account or debit card, limiting your liability in case you're the victim of fraud.

2. Card Rewards Are a Plus

Many credit cards offer rewards points and cash back. You can redeem these rewards for cash, gift cards, and even travel expenses. These points can be highly valuable provided you don't overspend to earn them.

3. Convenience Counts

Carrying a credit card is far more convenient than paying with cash or a check. Additionally, tools like mobile wallets allow you to connect your credit card to your smartphone or an app for purchases.

4. Credit Cards Can Help Build Credit

If you manage your credit cards wisely by paying your bills on time, ideally in full each month, you can help build your credit and improve your credit score. If you do carry a balance on your credit cards, by keeping your balance as low as possible (ideally less than 30% of your credit limit) you'll keep your credit utilization low. Credit utilization is the amount of debt compared to your credit limit and is a major factor in most credit scores.

5. 0% Interest Rates, in Some Cases

Some credit cards have 0% interest on purchases or balance transfers for 12 to 18 months.

6. A Grace Period

With credit cards, you essentially get an interest-free loan, or grace period, between 21 and 25 days. Any purchases made within your monthly cycle can be made interest-free until the payment due date (the following month). If you don't pay your balance in full on or before the due date, you'll owe interest on your average daily balance.

Drawbacks of a Credit Card

There are some potential credit card drawbacks and considerations when getting and using a credit card:

1. Credit Card Fees

One thing to consider is there are additional fees you may need to pay. Fees vary by credit card and may include:

- Annual Fees: Annual fees are charged on some credit cards, especially on high-value rewards cards.

- Balance Transfer Fees: A balance transfer fee is charged when you move a balance from one credit card to another, with the fee typically between 3%-to-4%. "Balance transfers usually hit people with credit card debt who have found a balance transfer offer with an introductory APR of 0%,"You should only pay a transfer fee if the interest you would pay on your current card is greater than the balance transfer fee you'll pay. And if you qualify, there are credit cards without balance transfer fees."

- Foreign Transaction Fees: A foreign transaction fee is charged whenever you make a purchase overseas, typically between 3% and 4% of your purchase. "To avoid this fee, you can get a credit card without foreign transaction fees," notes

- Late Payment Fees: A late payment credit card fee is charged if you don't pay at least the minimum payment by the due date on your credit card statement, "Avoid this by always making your payments on time,"

- Over-The-Limit Credit Card Fee: An over-the-limit credit card fee is charged if your balance exceeds your credit limit. You have to opt in to this fee, per the Credit CARD Act of 2009. Keep in mind that if you choose not to opt into this fee, your purchases may be rejected at the register if you go over your limit.

2. High Interest Rates

Another drawback is that credit card accounts are some of the highest interest rate debts consumers can access

"Installment loans like student loans, mortgages, auto loans, business loans, and even personal loans usually have much lower interest rates than credit cards," Alden notes. "For this reason, it's important to pay your credit card off each month rather than accumulate credit card debt, because it can grow exponentially."

3. Credit Card Debt

As money isn't automatically deducted from your bank account, you can potentially spend more money than you have. While it can be helpful to have a grace period to pay back your card or pay back money on your credit card over time, credit card debt is a growing issue in the U.S.

If you don't pay your credit card balance in full every month you'll likely incur additional charges. Also, if you don't pay your minimum payment each month or default on payments, you risk lowering your credit scores. If you do rack up charges on your credit card, you should make a plan as soon as possible to pay down your debt

Comments

Post a Comment